YOUR TRUSTED LENDING PARTNER FOR REAL ESTATE INVESTING

WE HAVE A PRODUCT FOR ALL OF YOUR PROJECTS.

FIX & FLIP LOANS

Short-term loans for the acquisition and renovation of residential properties. Quick closing!

NEW BUILD LOANS

Short-term loans for the acquisition, development, and construction of properties to sell or rent.

COMMERCIAL LOANS

Short-long term loans for the acquisition and renovation of retail and office properties.

READY TO GROW YOUR REAL ESTATE PORTFOLIO?

GreenLeap Capital Partners, a subsidiary of USA Technologies Group, Inc., is a privately-owned firm recognized for its efficiency, exceptional service, and reliability. Over the past decade, GreenLeap Capital Partners has provided financing solutions across all 50 states and the District of Columbia.GreenLeap Capital Partners, along with its network of lending partners, serves as a comprehensive resource for residential real estate financing. We offer a full range of REI products, including New-build, Multifamily Bridge, Fix & Flip, Commercial, Hospitality, Residential, Raw Loand, and 30-year Rental Loans.At GreenLeap Capital Partners, we have an in-depth understanding of your business because we are real estate investors ourselves. Having faced the challenges of dealing with traditional banks, we’ve developed a strong lending network specifically designed to streamline and support various real estate transactions.

START YOUR REAL ESTATE INVESTING JOURNEY STARTED TODAY!

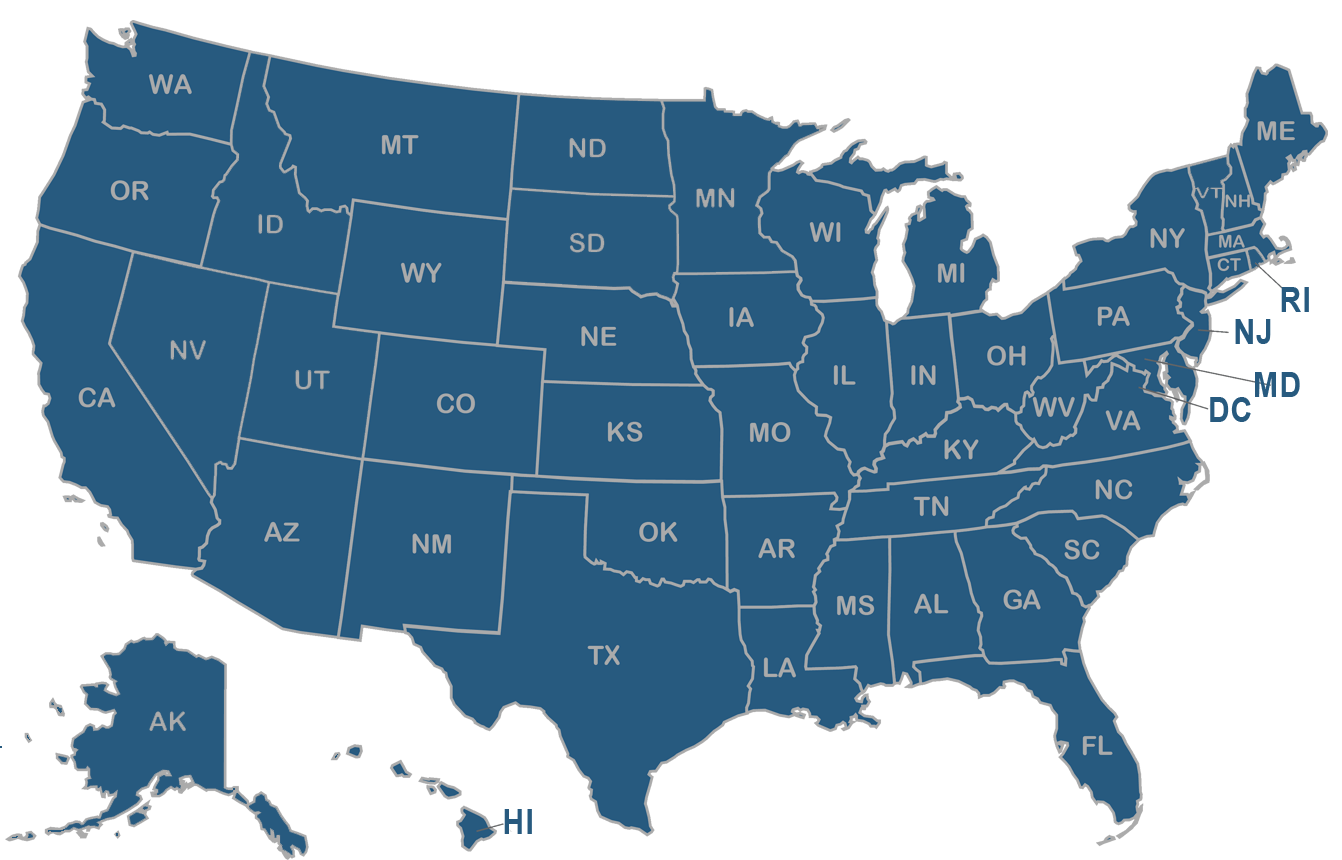

WHERE DO WE LEND?

GreenLeap Capital Partners lend in all 50 states including the District of Columbia.GreenLeap Capital Partners has the perfect loan for you in your state. Whether you have a commercial or residential property, GreenLeap Capital Partners has the perfect loan to get your funding quickly and easily.Please let us know how we can help!

GreenLeap Capital Partners offers financing to real estate investors nationwide, including the District of Columbia, while also presenting private, off-market real estate investment opportunities for purchase.Whether you're looking for turnkey properties or projects requiring renovation, we have investment opportunities tailored to meet your needs!

LOOKING FOR FIX & FLIP INVESTMENT OPPORTUNITIES?

Fix and flip investment opportunities involve purchasing properties, usually at a discounted price, that need renovation or repairs. The investor then improves or renovates the property to increase its value, with the goal of selling it quickly at a profit. This strategy focuses on short-term gains by "flipping" the property once it has been upgraded. Fix and flip investments typically require careful budgeting, project management, and a good understanding of the local real estate market to maximize profitability.

EXPLORE OUR FEATURED FIX & FLIP INVESTMENT OPPORTUNITIES

4-UNIT APARTMENT BUILDING

WASHINGTON DC - RANDLE HEIGHTS

PRICE - $750,000

BUILT - 1945

OCCUPANCY - VACANT

4 - 3BD 1BA

*ADDITIONAL UNIT CAN BE ADDED IN PARTIALLY FINISHED BASEMENT

VALUE ADD OPPORTUNITY

SECTION 8 VOUCHER OK

6-UNIT APARTMENT BUILDING

WASHINGTON DC - RANDLE HEIGHTS

PRICE - $1,200,000

BUILT - 1960

OCCUPANCY - VACANT

5 - 3BD 2BA

1 - 3BD 1BA

SECTION 8 VOUCHER OK

WHAT ARE TURNKEY REAL ESTATE OPPORTUNITIES?

Turnkey real estate properties are fully renovated homes or buildings that are move-in ready and require little-to-no additional repairs or improvements. These properties are typically purchased by investors who want to generate rental income immediately without having to oversee renovation work. In many cases, turnkey properties may also come with property management services in place, making them a hands-off investment option.

EXPLORE OUR FEATURED TURNKEY PROPERTIES

12-UNIT APARTMENT BUILDING

WASHINGTON DC - RANDLE HEIGHTS

PRICE - $3,200,000

BUILT - 1938

OCCUPANCY - FULLY OCCUPIED

12 - 3BD 1BA

*2 ADDITIONAL UNIT(S) MAY BE ADDED IN PARTIALLY FINISHED BASEMENT

VALUE ADD OPPORTUNITY

SECTION 8 VOUCHER OK

READY TO PURCHASE AN INVESTMENT OPPORTUNITY?

FIX & FLIP LOANS

We will assist with the purchase and fund 100% of rehab costs with a loan up to 75% LTV. 1-4 units 80% and 5+ 70%

• Available in all 50 states including the District of Columbia

• Flexible loan options to suit any size project

• 100% Rehab cost

• Rates as low as 10-12%

• $150K up to $10MM

• 6-18 month terms

• 2-3 point origination fee

• Easy rehab draw process

* LTV may vary. Based on experience.

READY TO RENOVATE, FLIP, AND REPEAT?

NEW BUILD LOANS

Our all-inclusive loan program finances both horizontal development and vertical construction costs on lots that are shovel-ready.

• Available in all 50 states including the District of Columbia

• Flexible loan options to suit any size project

• Up to 90% LTC (Loan to Cost)

• Up to 100% Vertical Construction Cost

• Up to 75% Horizontal Construction Cost

• Single property and portfolio loan options available

LET'S MAKE YOUR DREAMS YOUR REALITY TODAY!

BUY & HOLD LOANS

We will assist with the purchase and fund 100% of rehab costs with a loan up to 75% LTV.

• Available in all 50 states including the District of Columbia

• 30-year Fixed Rate

• Up to 80% LTV (Loan to Value)

• Rate Locks Available

• $100k Minimum Property Value

• 6-18 month terms

• 2-3 point origination fee

• Easy rehab draw process

BUILDING YOUR PORTFOLIO HAS NEVER BEEN EASIER!

MULTI-FAMILY LOANS

Our all-inclusive loan program finances both horizontal development and vertical construction costs on lots that are shovel-ready.

• Up to 70-75% LTC (Loan to Cost)

• Available in all 50 states including the District of Columbia

• Flexible loan options to suit any size project

• $150K up to $10MM

• 6-18 month terms

• 2-3 point origination fee

• Easy rehab draw process

BIG OR SMALL, WE CAN GET THE DEAL DONE!

WE'RE STANDING BY TO ASSIST YOU.

What states does Greeleap lend in?

Greenleap is happy to lend in all 50 states including the District of Columbia.

What loan programs does Greenleap Capital offer?

Greenleap Capital Partners is pleased to offer Fix & Flip Loans, New Build Loans, Buy & Hold Loans, and Multi-Family Loans.

Do you check title? Are there title fees?

As part of our standard process, all lenders require a clear and marketable title before loan approval. This step safeguards both our investment and your interests. We recommend reaching out to a local, investor-friendly title company or title attorney, who can provide a breakdown of fees related to securing the title.

Can I get approved for a loan with bad credit?

Yes, since hard money loans are asset-based, credit scores are less of a factor in the approval process. The focus is on the value of the property used as collateral. Be aware, that you'll incur higher costs for this type of funding, and you'll need to provide an explanation of your circumstances.

What happens if I default on the loan?

Since all loans are secured by the property, if you default, we may foreclose on the property to recover the investment.

Am I required to put up any capital?

While, in most cases, we prefer our clients to have some 'skin in the game,' there are certain deal structures and loan scenarios where it may not be required.

How is a bridge loan different from traditional loan?

Unlike traditional bank loans, bridge loans are asset-based and approved quickly, with less focus on credit scores or income. Interest rates and fees may be higher.

Are there any prepayment penalties?

No, you can pay off your loan early without incurring any prepayment penalties.

Is there a limit to the number of deals I can have?

No, we loan based on your financial situation. Therefore, as your income evolves, we will allow for more deals.

Do you lend based on the LTC or ARV?

LTC and ARV are key factors in determining your loan amount, but we don't base the calculation solely on the property's purchase price.

What types of properties will you lend on?

Greenleap will lend on Single Family Homes, Townhomes, Condominiums, Single Family Portfolio Rentals, Commerial, Retail, Hospitality, Raw Land, and Multi-Family properties.

LET'S GET STARTED!

Have any questions? We'd love to hear from you! Feel free to reach out by phone at (866) 200-6639, email us, or simply fill out the form to tell us all about your deal that you have.

Monday - Friday: 9am - 5pm EST

Saturday & Sunday: Closed

Phone: (866) 200-6639

Email: [email protected]

INVEST WISELY

Let your money take a LEAP.™

GreenLeap Capital Partners specializes in Commercial Real Estate and provides its private investors with a competitive return on investment (ROI) of 5-10% upon maturity.At GreenLeap, our strategy is simple... each deal we finalize is privately and exclusively selected and must enable us to add value in multiple ways to ensure a secure and robust investment for all parties involved.So Let's eat!

This should not be interpreted as an offer to sell securities.